From ZIRP to NIRP: Next Step in Dollar Collapse?

The Great Recession of the late “00s” (with the ’08 market crisis) may, or may not, have ended. However, the very low, to zero, interest rates that central banks have been charging commercial banks was supposed to encourage banks to lend, lend, lend, according to an analysis by private banking consultant P. Barron, published earlier this week at the Mises Daily web site.*

“Despite zero-interest-rate-policy (ZIRP) and multiple quantitative easing programs… the world’s economies are stuck in the doldrums.”

After pointing out that current zero, or near zero, interest rates are now being succeeded by negative interest rates, or NIRP — charging banks for the privilege of parking cash with the central banks, leading the banks to follow a similar policy with (initially) their largest depositors: “The central banks want to force the commercial banks to lend money in order to avoid the excess reserve charge. They appear poised to increase the so-far-nominal cost…”

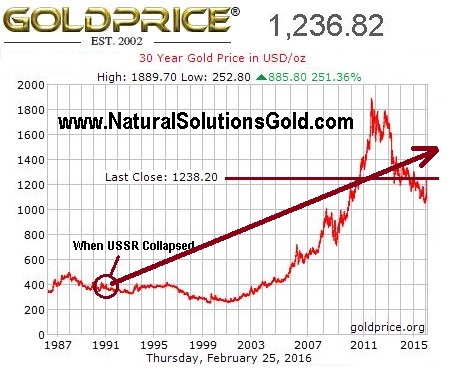

The large depositors, initially, and eventually all savers, will be forced to choose between putting cash on deposit at a negative interest rate, or spending the cash to buy assets (like gold) that are viewed as not likely to depreciate in value.

Where will this lead? Barron opines: “But can’t the central bank just print more helicopter money to save everyone? Unfortunately, no. More money cannot cure what too much money created.”

After the boom responding to the expansion of the money supply comes the bust. That has always been the view of the Austrian, or Free Market school of economics. This view is being recognized by an increasing number of academic and government economists as the alleged benefits of accelerating monetary expansion prove illusive.

Barron concludes, “…the suppression of interest rates has been unnecessary and harmful. Nevertheless, expect more central banks to follow the early leaders — Switzerland, Sweden, Denmark, and even the European Central Bank itself — into negative interest rate territory. The crying shame is that it will not work and will cause great harm to hundreds of millions of people.

—-

* https://mises.org/library/where-negative-interest-rates-will-lead-us